Are you planning to be an employee all your life?

or

Are you open to consider other options?

Do you have an employee mindset? Take this quiz now to see.

DO YOU BELIEVE THAT…

Each question describes a particular aspect of the mentality of most employees. If you answered all yes to the questions, then you have an employee mindset. While having an employee mindset is not bad at all when you’re working, it is not a useful perspective when it comes to personal wealth building. Answering no, to any of the questions means you are on your way to developing the entrepreneur within you.

Explanation:

A person’s net worth is used to determine one’s wealth and is computed as the sum of all assets less the sum of all liabilities. To increase wealth, you must have the mentality of accumulating assets not increasing income. A common misconception of employees is that you have to have a high income to become wealthy. The truth is you can become wealthy even on a minimum wage salary if you use your income judiciously and consistently to accumulate assets.

One key difference between an employee and an entrepreneur is this. When an employee finds something they really want but couldn’t afford, they dismiss it as something that they don’t need. Although identifying one’s want and needs is important when doing a budget, a more useful characteristic of entrepreneurs is that when they find obstacles they try to creatively solve their problems instead of outright giving up. The investor’s default mindset is to try to get what they want in some other way or another and be persistent about it.

For the typical employee, the first impulse once they get their salary is to spend it. This is the paradox of immediate gratification. People want to build wealth but the moment they get hands on money they want to spend it. Entrepreneurs on the other hand prioritize saving and investing and practice delayed gratification.They strive to accumulate assets first then use their assets, not income, to pay for expenses.

The first step to personal wealth creation is awareness of habits that prevent one from attaining one’s financial goals. Having an employee mindset is one such habit. To increase your awareness, you must realize the disadvantages of having this mindset, the root cause of why one thinks this way, then discover the ways one can reframe one’ thinking and develop the necessary skills to counter this mindset. The book Breaking Free From Employee Mindset details exactly what you need to know and develop in order to break this habit. Invest in yourself and learn from its lessons.

The Book

Features of the book

Get in Touch

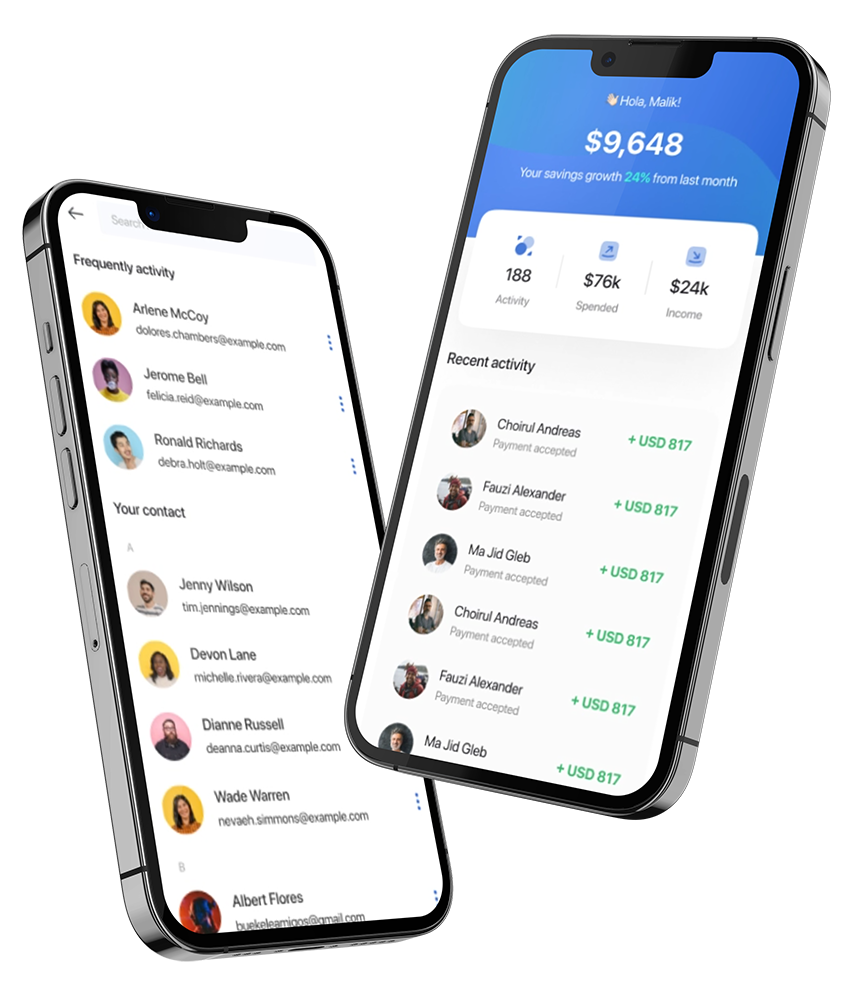

Tap into financial potential with savvy solutions.

Experience financial empowerment through our innovative solution designed to captivate and unlock new possibilities.